Next

2023

2024

- FCP recognized by Freddie Mac as 2024 Multifamily Impact Sponsor

Next

- FCP recognized by Freddie Mac as 2024 Multifamily Impact Sponsor

Next

- FCP wins Pensions & Investments Best Places to Work in Money Management Award for Second Year

- FCP partners with Standard Solar for 2.1-Megawatt Array System in Maryland apartment community

Next

- FCP joins consortium of industry leaders in establishment of Multifamily Impact Council

- FCP makes first multifamily and commercial acquisitions in Colorado

- FCP named as a “2022 Best Places to Work in Money Management” for companies with 50 to 99

employees as announced by Pensions & Investments in December.

Next

- FCP closed a $1.188 billion fund targeting multifamily and commercial property opportunities throughout the U.S.

- FCP expands its presence in the Midwest and West with an office in Denver, CO and investments in Texas.

- FCP was, for the second year in a row, named one of The Washington Post’s 2021 Top Workplaces in the Washington, DC area.

Next

- FCP employees came together to provide relief to those affected by COVID-19. Through FCP SERVES, the firm’s employee-led service program, and other food insecurity initiatives, the firm provided 675,000 meals to families in need via donations to food banks across the country. The company also ran a matching gift program, with matches provided by FCP leadership, to enhance personal contributions in the COVID relief effort. The team also developed guides for residents to assist in navigating the CARES Act as well as resources for home-schooling, social distancing, free access to high-speed internet, online classes, and wellness services.

- The Washington Post named FCP a 2020 Washington-area Top Employer. Selection is based solely on employee feedback gathered through an anonymous third-party survey that measured several aspects of workplace culture, including alignment, execution, and connection.

- Garland Faist and Jason Bonderenko were named Partners of the firm.

Next

- FCP moved its headquarters office to 4445 Willard Avenue in Chevy Chase, growing its space to accommodate more than 40 employees, double the firms’ size from seven years ago.

- FCP published its 2018 ESG report, highlighting 34 efficiency projects; 7 point increase in GRESB score

- FCP joined the Urban Land Institute's Greenprint Center for Building Performance

Next

- The Dillon, a landmark mixed-use development featuring both new construction and adaptive re-use of historic buildings in Raleigh, NC, opened its doors to its first residents.

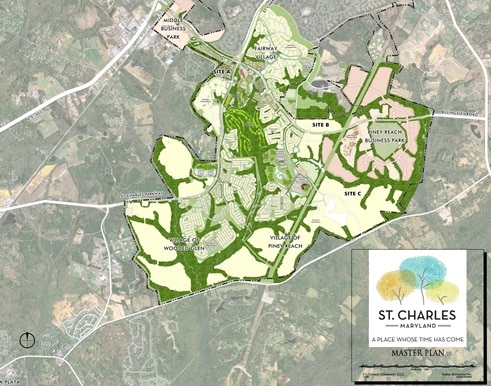

- FCP completed the disposition of the St. Charles apartment portfolio with the $71 million sale of three communities. Over a six-month period, the company sold a total of 2,661 apartment units in the portfolio for a combined $435.3 million.

- FCP announced the closing of FCP Realty Fund IV, L.P. (Fund IV), a $755.0 million fund targeting multifamily and commercial property opportunities throughout the Eastern U.S. and Texas. Fund IV, when fully invested, is expected to accommodate approximately $2.5 billion of total investments.

- FCP opened its Atlanta office, supporting the company's investment activity throughout the Southeast.

Next

- The FCP South Florida office opened.

- FCP was awarded the 2017 Community Leadership Award and a Citation from Senator Chris Van Hollen’s office for the company’s assistance in providing individuals in mental health recovery with safe and affordable housing.

- FCP and Cushman & Wakefield were recognized with NAIOP Northern Virginia’s Award of Merit in Leases Over 175,000 Square Feet for its work on One Dulles. The transaction will also garner one of the Washington Business Journal’s Best Real Estate Deals of 2017 awards, presented to the team in April 2018.

- FCP had its first closing on FCP Fund IV, a $755 million value add fund.

Next

- FCP made its first investment in the Atlanta area, acquiring buildings with a local partner for the Stockyards development, an adaptive re-use office and retail project in West Midtown.

- FCP closed its third fund, a $512.1 million fund targeting multifamily and commercial properties and structured opportunities throughout the Eastern U.S.

Next

- FCP expanded its East Coast footprint throughout the year with multifamily investments in Orlando, Tampa and Nashville.

- FCP formed its employee-led community leadership program, FCP Serves, committed to working alongside respected local organizations and leaders at the corporate, project and personal level and providing FCP employees with dedicated time to volunteer with community development organizations.

- FCP was ranked in the top half of US Residential fund managers and Value-Add managers in the 2015 Global Real Estate Sustainability Benchmark (GRESB) Survey. The firm was recognized as one of the top performers in identifying and implementing value-add efficiencies within its communities.

Next

- FCP entered the Charleston, SC market with an adaptive reuse development, The Cigar Factory, in a venture with a local developer. In 2016, the completed mixed-use development was recognized as one of “Preservation’s Best of 2015” by Preservation Action, the National Trust for Historic Preservation and the National Trust Community Investment Corporation.

- FCP recapitalized a six-property, 2,044-unit apartment portfolio in suburban Northern Virginia and Maryland in the largest Washington, DC area multifamily transaction of the year.

Next

- FCP was named one of the Top 10 Emerging Fund Managers by PERE Magazine.

- The Allegro, purchased as a “broken condominium” by FCP in 2010 and successfully recapitalized and converted into condo-grade apartments, earned Best Multifamily Sale at the Washington Business Journal’s Best Real Estate Deals Awards.

- FCP earned awards for economic impact (The Munsey, Baltimore, MD), financing (Gaslight Square, Arlington, VA), NAIOP’s Best Biotech/Science and Technology Project (National Cancer Institute, Frederick, MD).

- 1701 Arch in downtown Philadelphia was recognized by the Preservation Alliance with one of its 2013 Achievement Awards after a meticulous restoration and conversion of the building to luxury apartments by FCP and its partners.

Next

- FCP closed its second fund, a $529.2 million fund targeting multifamily, office, retail and industrial opportunities throughout the Mid-Atlantic region.

- FCP’s energy efficiency and utility reduction program, EcoSave, was launched and implemented through many of the firm’s communities.

- Gaslight Square in Arlington, VA was honored by Delta Associates as Best Mid-Atlantic Condominium.

Next

- FCP expanded its Mid-Atlantic footprint with investments in Raleigh, Chapel Hill, and Philadelphia

- FCP Raleigh, NC office opened

- New FCP headquarters office in Chevy Chase, MD opened

Next

- FCP grew its portfolio from 2009 through 2010, taking advantage of recession buying conditions, investing in more than $900 million of multifamily and commercial assets.

Next

- FCP closed on its acquisition of American Community Properties Trust (formerly NYSE: APO) in a stock purchase totaling $43.6 million plus the assumption of debt.

Next

- In September 2008, FCP closed on FCP Fund I, a $240 million co-mingled, private equity fund with commitments from a variety of institutional and private investors.

Next

- Tom Carr joined the firm as the fourth Managing Partner, after serving as Chairman and CEO of CarrAmerica Realty Corp. The four Managing Partners together have more than 117 years of commercial real estate experience.

- FCP was founded by Esko Korhonen and Lacy Rice, who worked together as Principals at The Carlyle Group. In 2002, Alex Marshall joined the firm, after working at the Real Estate Group at JP Morgan Partners. Between 2003 and 2008, FCP acquired a portfolio of real estate assets in the greater Washington, DC region with nearly $1.2 billion of market value. Most of the portfolio was sold by 2007.